As I set out to build a stock portfolio that earns $500 a month with a starting capital of $10,000 and getting to a total of around $100k in 12 months.

The strategy is no to pour the whole $100k into the market on day one, or day 60 for that matter.

Instead to look for value, wait for dips on desired stocks.

The fund for investing come from savings, earnings and selling some of the “stuff” that I’ve accumulated over the years and no longer use that much.

I also have a Line Of Credit (LOC) on my residential home that I can draw on of needed. I have no plans on using this facility unless extraordinary events occur.

First 5 Stocks

For the first 5 stocks I will be focusing on the top 50 by market cap that are good dividend payers.

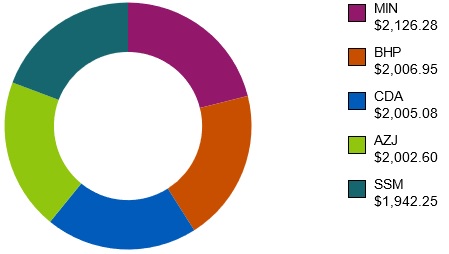

The funds will be divided into 5 lots of 2k so that each stock has the same amount invested to start with.

I don’t envisage the portfolio having more than 25-30 stocks. Well I hope not…

And so I get started with buying FMG, BHP, MIN, AZJ, CDA and SSM.

There’s a bit of a mix and all these stocks and I believe they are a good future earners.