Building A $500 A Month 100k Stock Portfolio continues with another month of volatility and some new stocks added to the “team”.

Mostly financials hoping that the increase in interest rates will also increase their returns.

Aristocrat Leisure, global gaming content and technology company and top-tier mobile games publisher.

Sonic Healthcare, medical diagnostic services and administrative services and facilities to medical practitioners.

Telstra, provider of telecommunications and information products and services.

Metrics Income Opportunities, portfolio of private credit investments.

Liberty Financial, housing finance, personal finance, commercial finance, motor finance, business finance and lease finance.

Kina Securities, commercial banking and financial services.

Also increased my holdings in Codan that is low yield but seems to have good and underrated growth prospects.

| Stock | Cost | Value |

| AGL | $1995 | $2351 |

| Ansell | $1987 | $1704 |

| Aristocrat Leisure | $1918 | $1841 |

| ANZ | $1958 | $1950 |

| Appen | $1996 | $1187 |

| Asia Technology Tigers | $2000 | $1368 |

| Aurizon Holdings | $2458 | $2852 |

| Bendigo Bank | $1996 | $2380 |

| BHP Group | $1979 | $2641 |

| Bank Of Qld | $2003 | $2080 |

| Codan | $3997 | $3276 |

| CSL | $2736 | $2688 |

| Fortescue Metals Group | $2000 | $3085 |

| Kina Securities | $2021 | $2010 |

| Liberty Financial | $2007 | $1993 |

| Magellan Financial Group | $5327 | $3597 |

| Metrics Income | $2009 | $2008 |

| Mineral Resources | $2009 | $3024 |

| Platinum Asset Management | $2004 | $1392 |

| Rio Tinto | $3930 | $4963 |

| Service Stream | $2004 | $1907 |

| Sonic Healthcare | $1986 | $2052 |

| Suncorp | $1986 | $2017 |

| Telstra | $2009 | $1999 |

| WAM | $2005 | $1909 |

| Soul Pattinson | $1986 | $1730 |

| Wesfarmers | $1999 | $1997 |

| Westpac Banking Corporation | $2930 | $3137 |

| Zimplats | $2056 | $2932 |

| Portfolio Value | $67603 | $68065 |

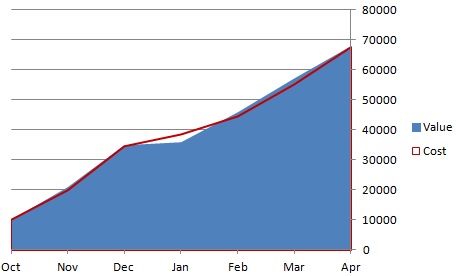

And a nice little equity graph

Dividends

I received $40.19 in dividends making the total income $1621.36.