Portfolio Goal

The objective of this portfolio strategy is to generate sufficient passive income to fully cover my essential living requirements—including utilities (electricity, water & sewer), property maintenance, gardening services, health insurance premiums, and fundamental nutritional needs.

Having successfully eliminated mortgage obligations several years ago, I’ve positioned myself advantageously for this passive income approach.

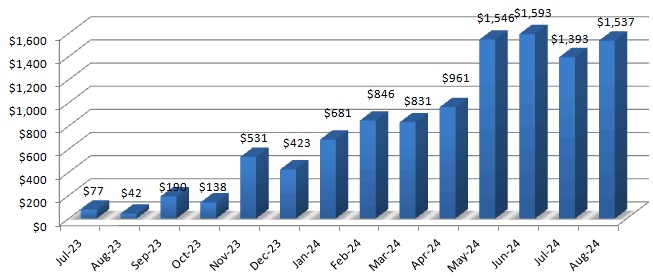

My current basic annual expenditures total approximately $30,000, translating to a monthly requirement of $2,500.

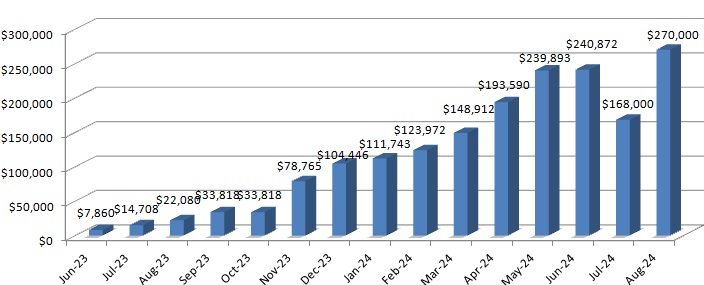

To reliably generate this income stream, I’ve calculated the necessity for a portfolio valued between $500,000-$600,000, strategically allocated among high-dividend yielding equities.

This idea is to focus on establishing a sustainable income foundation that provides financial security without depleting principal capital and create a reliable income stream that adjusts for inflation while maintaining portfolio integrity.

Portfolio Summary

The month of Aug saw more of the same. Yes investing can be boring though I did get a bit of excitement buying $53,380 worth of TCF during the month.

I don’t expect much capital growth as earning are mostly distributed, yet it’s nice to see a small gain on the overall portfolio.

Stock transactions fro August 2025

- Added 2198 shares of KKR Credit Income Fund (KKC)

- Added 7422 shares of Qualitas Real Estate Income Fund (QRI)

- Bought 9773 shares of 360 Capital Mortgage REIT (TCF)

Current Portfolio Composition

| Company | Quantity | Cost | Market Value |

| Cromwell Property | 6,409 | 3,021 | 2,660 |

| GCI | 7,354 | 14,967 | 14,928 |

| KKC | 7,408 | 16,966 | 17,187 |

| PLATO | 54,192 | 59,990 | 66,114 |

| QRI | 36,916 | 59,897 | 60,542 |

| TCF | 12,188 | 66,535 | 67,278 |

| Total | 221,376 | 228,709 |

Aug 2024 Dividend Income

My FIRE dividend portfolio produced $1537 of passive income. It fun and exciting as I’ve never earned so much from just dividends. Still a relatively small number but it’s enough to pay a few monthly bills and just the thought that this income may be coming in for years to come without having to do anything brings me joy.

Now back to the task at hand.

- GCI: $105.16

- KKC: $123.71

- PL8 $425.80

- QRl: $380.96

- TCF: $100.63

- Interest: 400.74

Total dividend income recieved for 2024 is now $9,334.

Portfolio Analysis & Future Outlook

A chunk of cash was invested, still some more to go plus more capital added as I feverishly try to sell “stuff” that I haven’t used in years. Allmost 15k alone came from selling old musical instruments that sat hidden away for years. And much still more to go.

In Summary

I hope sharing these updates provides inspiration or at least curiosity for readers considering their own passive income strategies. Whether you’re planning for early retirement or simply seeking greater financial independence, dividend investing offers a path to building wealth and generating income with minimal ongoing effort.

Happy investing!

Note: This update represents my personal investment approach and should not be considered financial advice. Always conduct your own research or consult with a financial professional before making investment decisions.